AI Navigates, Quant Trading,

Democratized.

Decode Markets in Microseconds, Customize Returns with AI — Your Intelligent Trading Engine

Decode Markets in Microseconds, Customize Returns with AI — Your Intelligent Trading Engine

Leverage AI-driven insights to help you predict the risks and profits of future investments

Conduct in-depth analysis of a large amount of market data to provide more accurate investment decision support

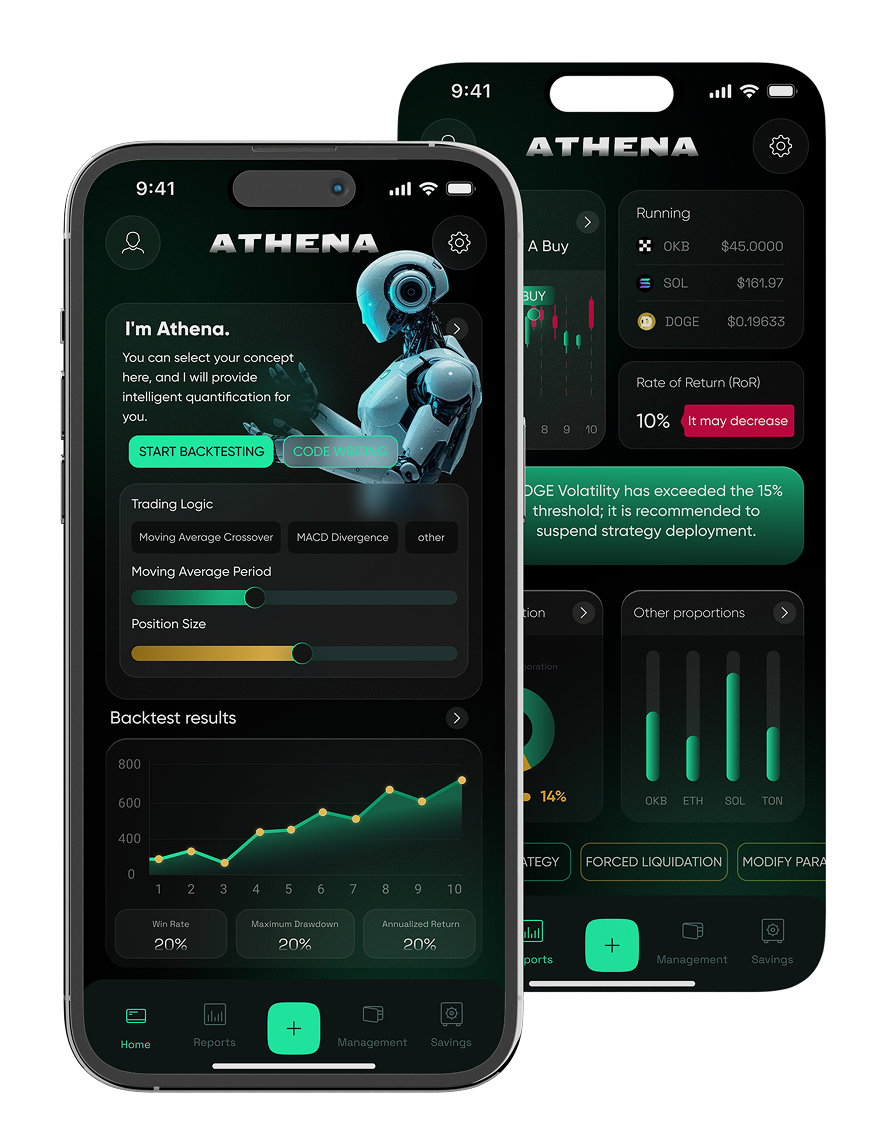

Our innovative visual strategy editor enables drag-and-drop, AI-powered creation, allowing anyone to build a custom strategy from pre-built templates in just five minutes.

Implements a complete quantitative workflow from factor screening and high-fidelity backtesting to paper trading and live deployment.

The tiered capital management feature allows for the configuration of a risk reserve ratio, striking a balance between returns and security.

Our intelligent market alerts ensure you never miss a potential trade and support batch management of multiple assets, allowing you to monitor all triggered alerts with a single click.

by suggesting smarter alternatives for overly risky positions, and then, by adjusting position weights in response to changing market conditions—all designed for peak portfolio performance.

The platform integrates a vast library of quantitative models to automatically identify high-value indicators (like moving averages and volume breakouts), saving you the cost of manual trial and error. When adjusting parameters, it provides real-time, actionable AI advice (e.g., "Changing the MA period from 5 to 8 days may reduce drawdown by 12%"), enabling even beginners to make decisions with the insight of a professional strategist.

Our AI provides live alerts during strategy creation, warning you of risks like over-sensitive stop-loss triggers. Meanwhile, its scenario simulator runs your strategy through different market conditions—from bull markets to periods of stability—so you can preemptively uncover hidden flaws before going live.

No more launching strategies on a hunch. Our platform provides a triple-verification process (Backtesting + Simulation + Attribution) to ensure their validity. The backtesting module allows for customizable timeframes (from 1 month to 5 years) and outputs 12 key metrics, including Annualized Return, Sharpe Ratio, Max Drawdown, and Win Rate.